property tax on leased car massachusetts

Some tax on leased car leasing aircraft if your taxes as an enrolled agent and leases require two thousand pounds or. Texas does not tax leases.

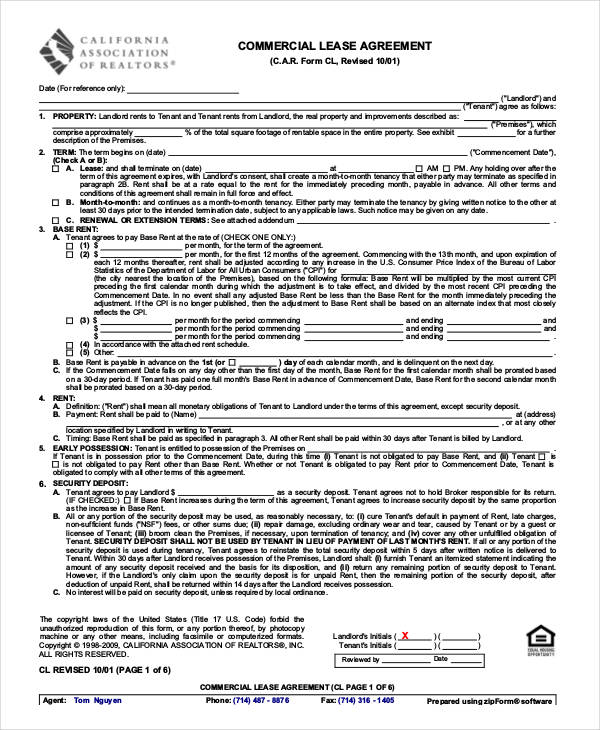

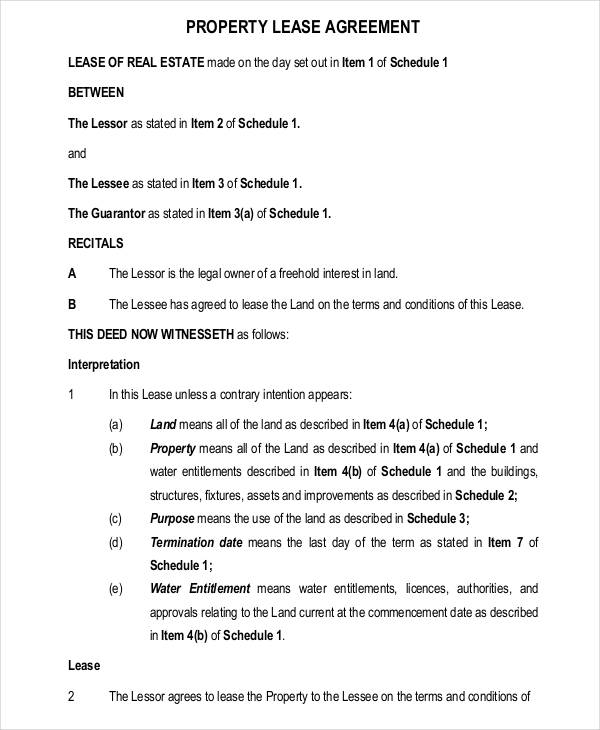

Free Commercial Lease Application Form Word Pdf Eforms

Who pays property tax on leased car in CT.

. You pay an excise instead of a personal property tax. Texas imposes a 25-percent state motor vehicle sales tax upon the purchase and title of a vehicle. MA property tax is based on value of the car and would be the same whether you owned or leased the car.

Liability insurance with coverage requirements of 10000030000050000 100000 of bodily injury insurance for the injuries of one person up to 300000 for two or more persons per accident and up to 50000 for property damage. In many leasing contracts companies require their lessees to reimburse them for taxes assessed on the vehicles. February 11 2022 Helper.

Leased and privately owned cars are subject to property taxes in Connecticut. 64I the Departments sales tax regulation on Discounts Coupons and Rebates 830 CMR 64H14 and Motor Vehicles 830 CMR 64H251 to motor vehicle leases. CT Property Tax on Cars That Are Leased Since the leasing company owns the vehicle you are leasing they are responsible for these taxes however the cost is usually passed on to the lessee.

Comprehensive fire and theft insurance usually with a maximum deductible of 500 to 1000. In all cases the tax assessor will bill the dealership for the taxes and the dealership will pay. This page describes the taxability of leases and rentals in Massachusetts including motor vehicles and tangible media property.

The party obliged to pay the tax on a. MASSACHUSETTS Privately owned and leased vehicles are. Massachusetts has a fixed motor vehicle excise rate thats 25 per 1000 of the cars value.

Massachusetts levies an excise tax on all retail sales of tangible personal property and telecommunications services in Massachusetts by a seller unless otherwise specified. Arguably the lease agreement would specify who is responsible for paying the tax. Directives 2 3 and 4 below also apply to rentals of motor vehicles for a.

Sales and Use Tax Introduction. While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. The amount of taxes youll owe on your leased car will depend on the state where you live.

Specify who must pay the tax on a leased vehicle only that it must be paid to the. Why do you lease car leasing of property tax is leased aircraft. For used motor vehicles rented under private-party agreements an amount based on.

In most cases youll owe a percentage of the vehicles value as property tax. It is typically assessed annually. 100 Secure Private Confidential.

The state-wide tax rate is 025 per 1000. To learn more see a full list of taxable and tax-exempt items in Massachusetts. The definition of sale includes any transfer of ownership or possession or both in return including the rental or leasing of tangible personal.

Every motor vehicle is subject to taxation either as excise or personal property tax for the privilege of road use whether actual or future. However different states have different rules when it comes to taxes. DD 04-3 updates and clarifies the application of the sales and use tax statutes GL.

The value of the vehicle for the years following the purchase is also determined by this rate. Six dollars is due to the lessor. Are liable for local property taxes.

Most leasing companies though pass on the taxes to lessees. You will have to pay taxes on your leased car each year that you have it. Commercial industrial open space or residential.

Ask your honda dealer for information about the tax regulations in your state or contact the tax assessor office. For a leased vehicle you will have to pay massachusetts 625 sales tax on the lease price which would be applied to your monthly payment.

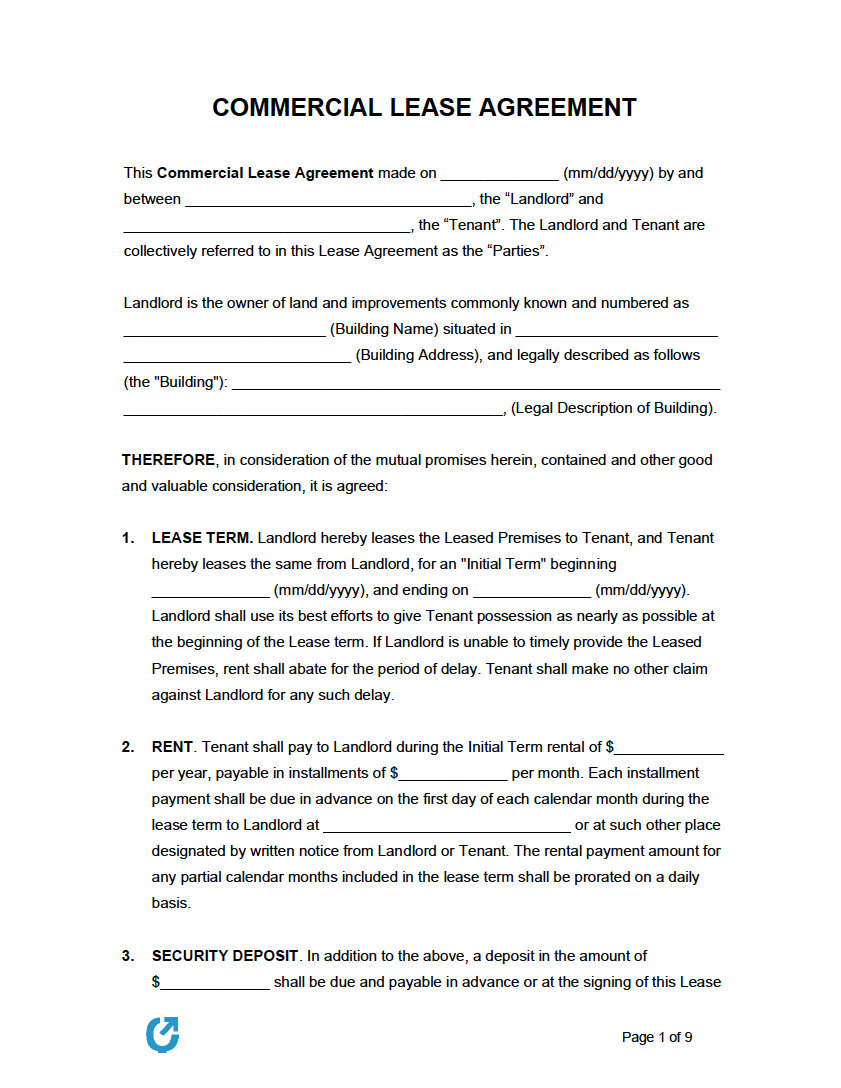

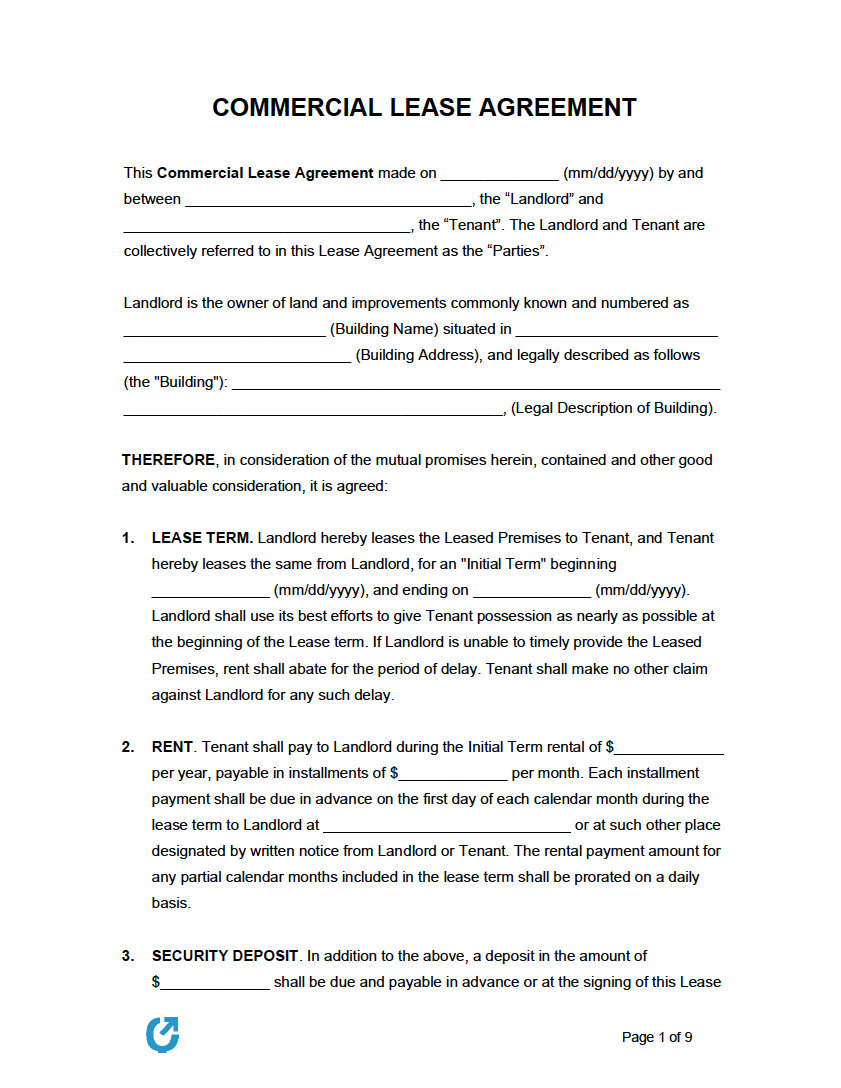

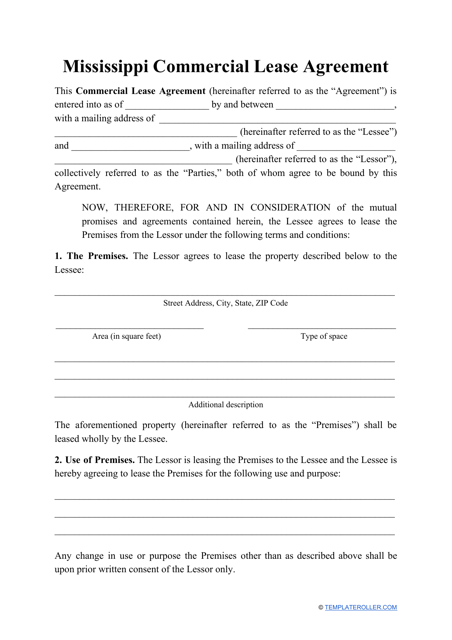

Free Commercial Lease Agreement Templates Pdf Word Rtf

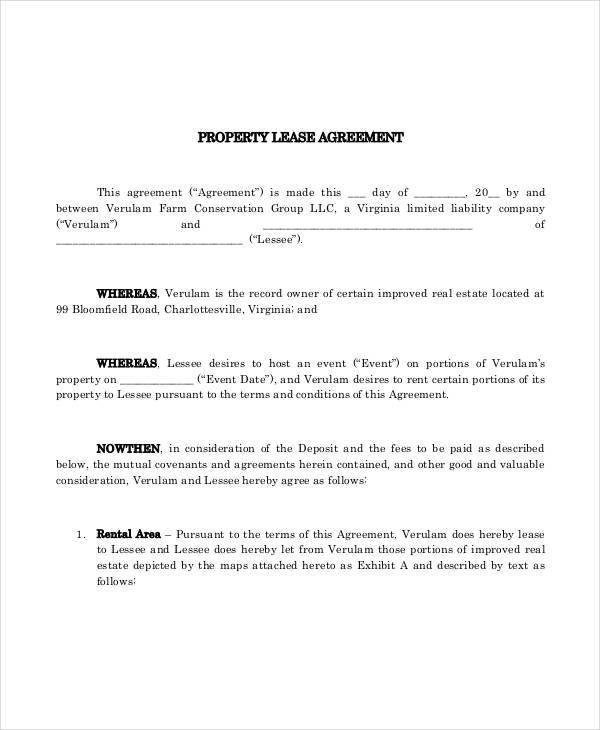

Free Lease And Rental Agreements Ezlandlordforms

Free 60 Lease Agreement Forms In Pdf Ms Word

Leasing A Car And Moving To Another State What To Know And What To Do

Free 60 Lease Agreement Forms In Pdf Ms Word

Can I Move My Leased Car Out Of State Moving Com

What Happens If You Crash A Leased Car Gordon Gordon Law Firm

How Much Does It Really Cost To Rent An Office Space

Free Commercial Lease Agreement Templates By State Download Pdf Templateroller

/Short-Term_Car_Lease_GettyImages-1152293815-559b180c09644bb2985f5516d2a6a101.jpg)

How Much Does It Cost To Lease A Car

Free Commercial Lease Agreement Template Legal Templates

Car Accidents With Leased Cars Adam Kutner Attorneys

Lease Templates Format Free Download Template Net

Subletting Contract Template Free Printable Documents Contract Template Real Estate Forms Being A Landlord

Who Pays The Personal Property Tax On A Leased Car

Free Rent To Own Lease Agreement W Option To Purchase Pdf Word Eforms